Time is money.

This is an old but true statement, well appreciated by Logisticians. My previous blogpost discussed the Logistics involved with Services Delivery. Another aspect is Services Support, which addresses the up-time of items to obtain an outcome for an organisation . The three approaches are:

- Asset Support Logistics

- Product Support Logistics

- Humanitarian Logistics

Asset Support Logistics

When a major capital purchase is announced, the emphasis is often placed on the initial purchase price. However, the installation, planning of servicing throughout the equipment’s operational life, obtaining and storing replacement parts, developing staff capabilities and product disposal will typically total about 60 percent of lifetime costs, while the purchase price is about 30 percent.

Asset Support Logistics is the group of activities used to support assets over their life. Examples where Asset Support Logistics (under many titles) is found are:

- continuous production operations i.e. petrochemical, steel, aluminium, open cut mines and offshore oil rigs

- major service facilities, such as air and sea ports and entertainment complexes

- utilities (electricity, gas and water) and telecommunication infrastructure

- airlines and

- military weapons systems, including defence equipment (tanks, aircraft and ships)

High investment in capital equipment can mean that risks associated with failure are high. A recent example is an entertainment complex in Australia where an operational fault resulted in fatalities. The business was shut for 45 days, revenue for the half year fell nearly 30 percent and earnings were halved. Reputation damage may result in lower revenues for some time into the future.

The key goals of Asset Support Logistics in managing the total life cycle of equipment are to:

- Evaluate, with Engineering and Procurement, the consequences of design decisions on the availability, reliability, maintainability (ARM) of equipment, parts and components

- Develop and implement the Logistics assets support plan

- Establish requirements, using analysis, such as mean-time between failure (MTBF), for replacement and rotable parts (both on-call and held in inventory)

- Identify and reduce lead times and total landed cost of critical parts

- Build collaboration with the groups responsible for planning and scheduling, procurement, accounting and IT systems

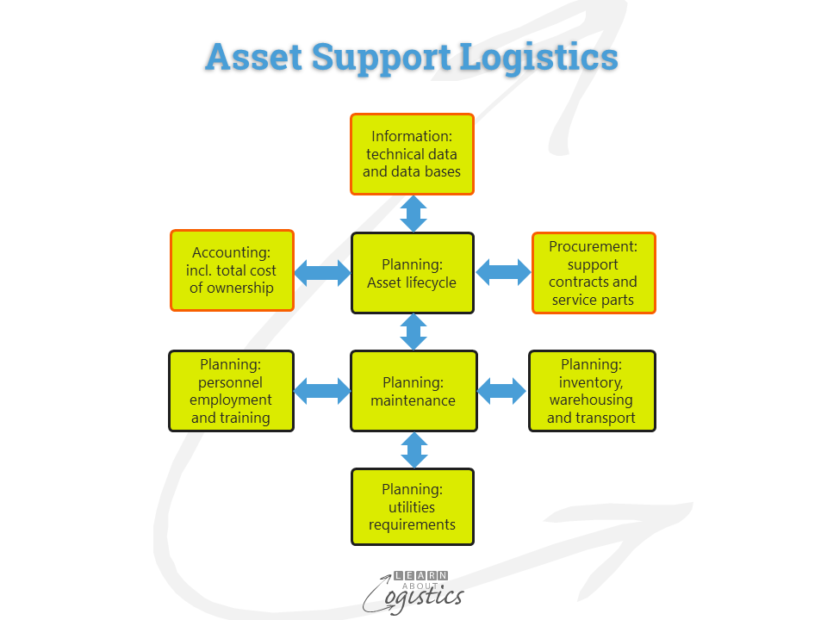

The diagram illustrates that to achieve the goals, activities should be structured to address six areas of responsibility:

- Asset Lifecycle – planning the support required prior to purchase of capital items has a profound effect on the total life cycle costs of an asset, as there are major operational cost inputs connected with maintaining an asset and buying services and spare parts. Establish failure modes and probabilities; consequences of failure with respect to safety, reliability and maintainability

- Information Systems – acquire or design and develop the IT and communication systems

- Technical Documentation – repair and operating manuals, maintenance documentation, technical repair standards, drawings, parts lists and usage plans

- Accounting: the central feature should be Life Cycle Cost (LCC). This approach assists understanding of the total cost (both recurring and non-recurring) over the life cycle of an item. The objective is to minimise total lifetime costs through consideration of costs, performance required and level of support, critical resources availability, risks and trade-offs

- Procurement – using budgets as a guide, focus on the availability, reliability, maintainability (ARM) elements of the buy, rather than price

- Planning: maintenance, inventory (incl. warehousing and transport), people and utilities

- People training regimes at the operational and support levels

Each of these elements can be performed internally by the enterprise, tasks contracted out or complete functions outsourced to external specialist service providers. The more specific the capital equipment, the more likely that support will be provided by services suppliers. The organisation structure will reflect the priorities, but Planning the Asset Support lifecycle should remain in-house, similar to supply chain strategy in FMCG and CPG organisations.

There are three factors that could influence how Asset Support Logistics will operate in the future. They are new technologies, Performance Based Contracts and the Circular Economy.

New technologies: From articles I have read, the applicable technologies that could influence Asset Support Logistics are Connected Devices within and between equipment that provides ‘big data’ for predictive analytics and pattern matching and Mobile and Wearable Technologies used in large sites.

Performance Based Contract (PBC): This is also called availability-based contract (ABC), ‘power by the hour’ and in the military, Performance Based Logistics (PBL). PBC was developed to ‘buy performance not the product’, so it increases the risks on the supplier – if the performance targets are not achieved, then payments can be reduced or withheld. Suppliers that invest resources in the process have the potential to replace price with performance capability as the major buying criteria. This provides the opportunity to increase profit margins, concurrently with providing improved services for the client.

The concept of the Circular Economy will influence decisions concerning Asset Support Logistics. Emphasis on the lifecycle costs means that items will be more often considered for refurbishment or re-manufacturing; requiring the return of worn and damaged equipment and parts to re-manufacturing factories. Here, parts are refurbished and returned for re-use or products are re-manufactured and re-enter the sales channels. For companies that sell and support capital equipment, this element of reverse logistics can be more complex to plan and schedule than the make and sale of the original equipment.

Product Support for consumer products (also called after-sales service), is the less glamorous part of customer service. While much effort can be put into selling the original item, the total customer experience can be poor, due to the lack of product support.

Product Support can be for home products such as electrical goods used in the kitchen (white goods), electronic and electrical goods used elsewhere in the house (brown goods) and motor vehicles. Typically the product must be taken by the consumer to a repair centre; the time taken for repair can range from days to weeks, depending on where the spare (or service) parts are located and how much work is awaiting completion (the backlog) in the repair centre.

Product service can be performed by the product brand company as a part of its overall offering to customers. The function can also be outsourced to a specialist product support company. However, the critical element is inventory management of replacement parts. Ideally, part availability and order fulfilment must be quick, but parts are often poorly tracked concerning location and number. The causes of poor availability are:

- while products are sold on global markets, a product sold in one country or region may not be sold in another, so stocking locations must be carefully managed

- products are usually under continuous improvement, so parts can change over time within a product model

- parts can be made by suppliers located throughout the world

- parts can reside across multiple supply chains; in central DCs, remote depots and service vans

Humanitarian Logistics and Disaster and Emergency Logistics

The term Humanitarian Logistics is used in international relief operations, while Disaster and Emergency Logistics defines domestic-based operations. These activities incorporate features of the previous Support Logistics disciplines; providing support for the relief operations that bring life-saving medicines, food and materials to people affected by a disaster. This involves everything from issuing relief supplies, to holding service parts that keep helicopters in the air in difficult conditions, to organising ground traffic to get through inhospitable country and maintaining communication links.

While the emphasis in education and training and the media is concerned with FMCG and CPG organisations and LSPs, the growth of services is greater than products. There could be more opportunities for Logisticians in Services Delivery and Services Support than in product movement.