Value of the total Workforce

It is common for Chairman and CEOs of companies to inform shareholders at AGMs that ‘our people are the most valuable asset’. Yet if challenged about the value, they would not have a number to support the statement.

Experiences through the COVID-19 epidemic have shown that people are the ‘make it happen’ force behind supply, production and distribution of goods and services. Even the technologies used to enhance the productivity of people is the result of other people using their knowledge and skills.

Remote working (working from home or at a decentralised location near to home) requires a higher level of self-management, and initiative, which enhances the intellectual capability required of employees. In addition, there is now a business environment in which disruption and change are an expected condition, which require organisations and their supply chains to adapt. At all levels in your organisation, people will need to develop:

- A mindset about the expectation for adaptation and change

- Creativity in problem-solving

- An awareness of sustainability, resilience and business continuity as it affects the business

- An awareness of the organisation’s reputation and the potential for a downgrade in perception by customers and consumers

The workforce in your business should be viewed as an asset rather than an expense (or worse, a liability). However, in traditional accounts, the line items concern physical activity. The Profit & Loss (P&L) Statement gathers all the sales-side income and expenditure under the sales and administration headings. The supply-side expenditure is grouped under the heading of ‘cost of goods sold’ (COGS).

By using this approach, it is not clear about the expenditure incurred in supply markets to purchase materials, components and products, or for service contracts with Logistics Service Providers (LSPs). Nor is the contribution that people in the business have made.

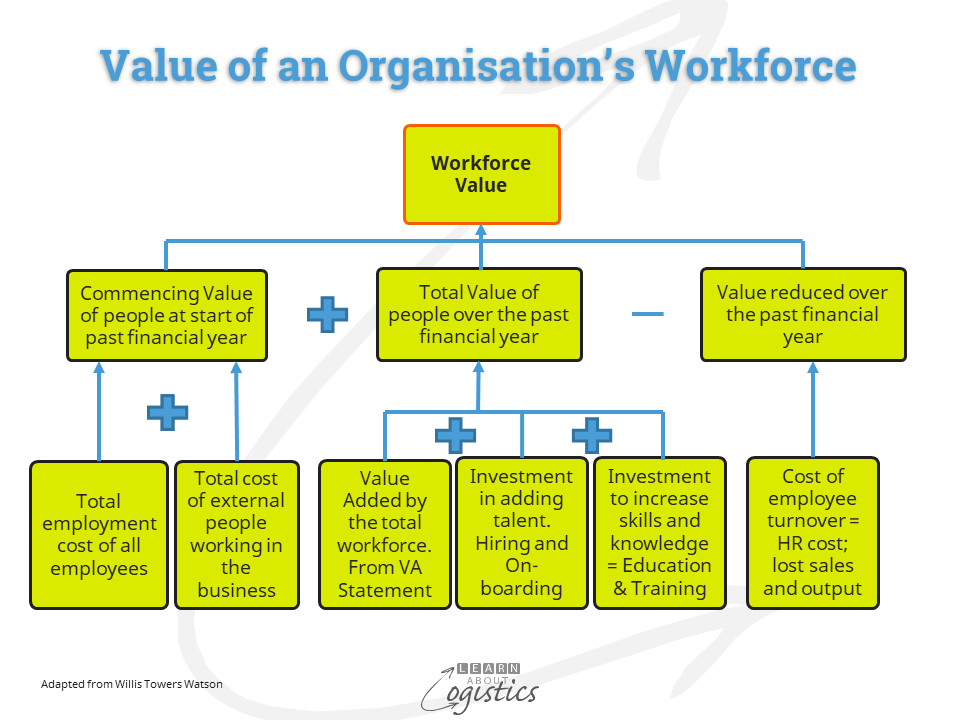

Consequently, sales revenue and net profit continue to be viewed as critical financial measures. While these measures are important, the financial value of people to the organisation must also be recognised. The diagram provides a model to identify the value.

The model takes the value of people at the commencement of this financial year, adds the value of people over this financial year and subtracts the value of people lost.

Although the retrenchment of people may assist profitability of a business over the short term, there is a loss of knowledge, which has a cost. Future rehiring, on-boarding and training of new employees can take time, incur higher costs and may initially reduce productivity. For a business with customer facing employees, the brand can be damaged by perceptions of the business gained from articles and comments in the media. Also, are the ‘moments of truth’ that may happen over the ‘last yard’ between staff and consumers, currently evident at airports in some countries.

Value Added Statement

The important factor that enables the model to be actioned is the Value Added (VA) Statement for a financial year. As reporting under ESG (environment, social and governance) requirements is gaining acceptance, there are moves to adopt Value Added Statements as the basis to value an organisation’s workforce for use of their imagination, skill, energy and time. Also, for use as a measure of corporate performance.

The concept of Value Added is that for a saleable product or service to be offered, it requires people to change the form of purchased materials, components and services, using the physical resources provided – land, buildings, machines and money. Even businesses selling finished goods incur costs to place the item for sale on a shelf.

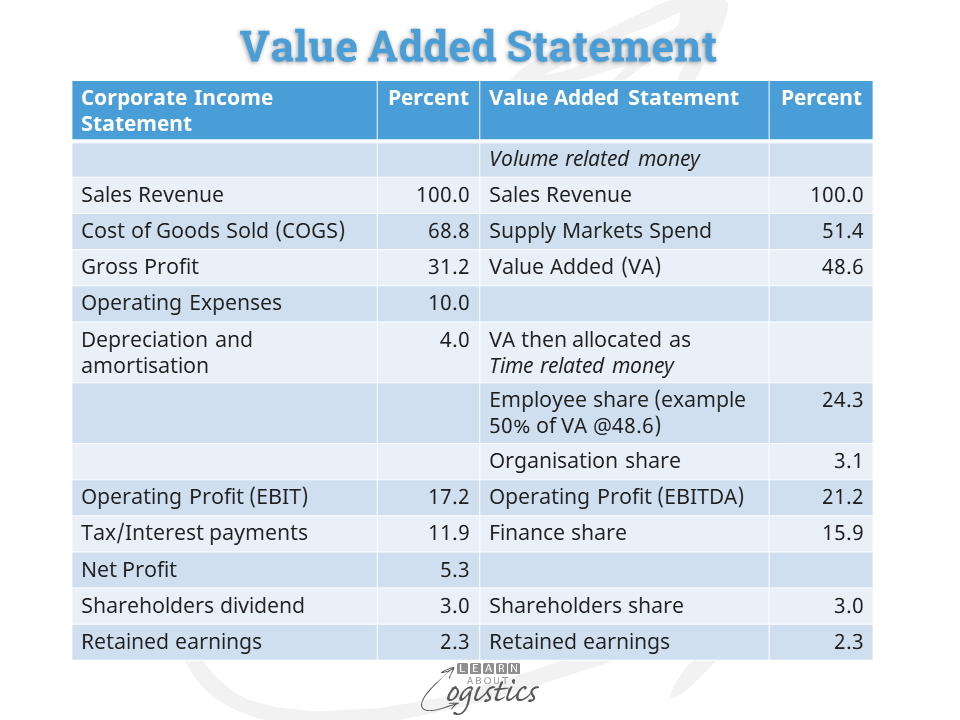

The diagram compares the traditional accounting presentation on the left side and the Value Added Statement. To calculate the Value Added by people in the organisation, the Value Added Statement column shows the sales (net of royalties etc.) of items, then subtracts the total landed cost of materials, components and services to provide the Value Added. In summary, ‘People add value, technology reduces costs’.

The important factor is that the traditional accounts and the VA Statement use the same base numbers but presented in a different format. In corporate annual reports, companies can present the traditional financial accounts, with the Value Added Statement as an addendum or supplementary disclosure.

In the VA column of the diagram, ‘Employee share’ is the total cost of employing all staff (including senior executives), with HR providing the numbers. If a business has outsourced some functions, sales are obtained with a lower ‘Employee share’; however, the cost of purchases will increase, so less Value Added is achieved by the business.

The ‘Organisation share’ is the costs incurred to legally establish and maintain the business, such as registrations, licences, professional audit fees etc. ‘Finance share’ reflects the money paid to banks and financial firms as interest on borrowings and to tax authorities. ‘Shareholders share’ is money paid to investors as dividends on common shares.

Benefits of using a Value Added Statement

Publication of the VA Statement means that management and staff know how the shares of the VA ‘cake’ are divided. At the annual review of salaries and wages, positive discussions can be held concerning the actions required fund any increases:

- increase the VA (increase prices or reduce the total cost of ownership (TCO) of goods and services),

- reduce the non-financial part of ‘Employee share’ (e.g. children’s creche, vehicles for executives etc.)

- reduce the Organisation or Finance share or

- reduce ‘Shareholders share’ or ‘Retained earnings’

Benefit is also available to the Supply Chains Group (Procurement, Operations Planning and Logistics), as the total cost of Supply Chains to the business is available for directors and senior managers. The total cost consists of the supply markets spend on purchased items and services (shown in the VA Statement), plus the total cost of Supply Chains Group employees (from within the ‘Employee share’ of the VA Statement). The value of the Supply Chains Group to the business can also be measured, viewing the Supply Chains Group employee total cost as a percentage of the VA.

Value Added is a transparent measure for how the performance of your business (and the Supply Chains Group) can be measured and as the basis for paying executive’s bonus. This means that Value Added becomes a measure for oversight by the board of directors, which is essential if the Chairman is serious about ‘our people are the most valuable asset’.

One Comment on “Supply Chains Group gains from a Value Added Statement”

Great Content. Thanks for sharing this information with us.