Know more about your money flow.

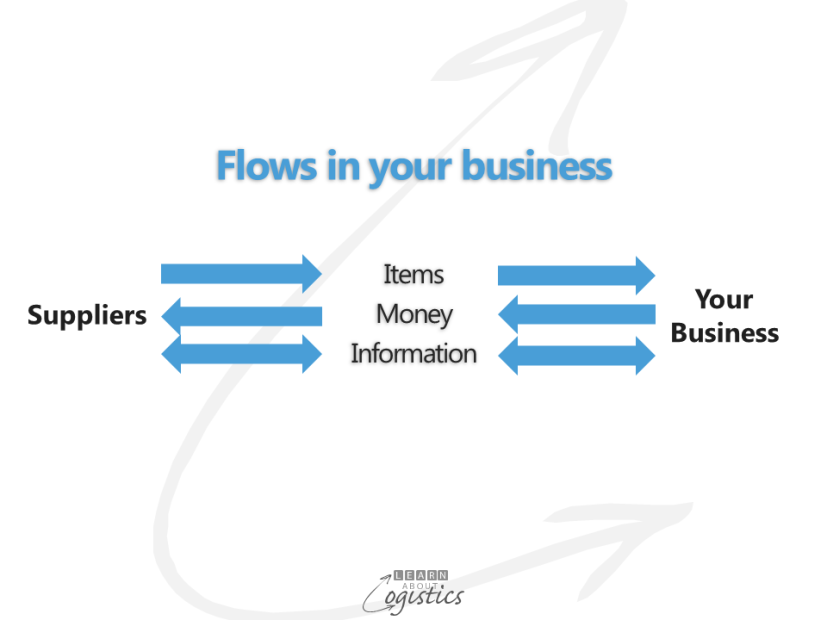

Aiming to be ‘excellent’ through the supply chains in which your business operates, requires that you address the three flows of each supply chain.

A logistics professional is expected to know a lot about the flow of items, be they materials, components or finished products. Increasingly there is an expectation that knowledge of information flows will extends beyond the transaction elements of ERP systems.

But what about the flow of money? For logistics professionals, their specific knowledge must address how financial decisions affect supply chains and in what circumstances they should use financial management for improving the supply chains.

In my most recent blog post, I discussed working capital and measuring supply chain financial effectiveness through calculating the cash to cash cycle. In the previous blog post, the logistics financial measure of cost to serve was discussed. For a rounded knowledge of finance, supply chain and logistics professionals should at least understand the additional principles and practices of:

- Return on Investment (ROI), including the strategic profit model or Dupont chart

- Cash flow and liquidity

- Tax and transfer pricing decisions

- Customs duties, VAT/GST and other payments with reference to inventory location issues and

- Lease verses buy financial decisions

- Commodity futures trading

Completing your financial knowledge is the topic of financing supply chains. This is likely to be of increasing importance into the future, due to technology developments that allow the identification of items through supply chains and to quickly advise all interested parties of the status. The current example is radio frequency identification device (RFID) communications technology and bar code support for the ‘track and trace’ of items; this is allied with ‘cloud’ based IT systems to improve information flows between parties in a supply chain. As this technology is implemented, it will facilitate co-operation and co-ordination between the finance and supply chain functions.

The outcome of improved co-ordination will be a better understanding of, and solution to the payment dilemma. For buyers and accountants there is the pressure to extend the time in which to pay suppliers – often because the buying organisation has not been paid by its customers! At the same time, suppliers have limited access to money that will cover the shortfall in their collection of debts from buyers.

To overcome the dilemma, solutions are required that speed the flow of money through supply chains using a third party financial services provider.

Financing supply chains

To access the three financial functions of interest to supply chain professionals, use the working capital structure. The functions are: inventory, accounts receivables (debtors) and accounts payables (creditors). The objective is to improve the flow of flow money between parties, as the flow of items and information improves. The finance industry and academics have discussed supply chain finance (SCF) for many years, but the concept has been slow to gain acceptance in industry. This has been due to technology constraints, complexity of compliance and the continuing use of well established financial instruments, such as letters of credit (LCs).

The most established financial instrument used in supply chains is Factoring, which addresses the accounts receivables (A/R) of supplier businesses. The current approach enables suppliers to sell all or some of their A/R asset, at a discount, to a financial organisation. The lender (or factor) typically selects the accounts they will pay the supplier against invoice and later, collects the money due from the buyer at the invoice date. A variation is called Invoice Discounting, where the finance company purchases (again at a discount) the complete A/R account, but the supplier business remains responsible for collecting the money.

While this approach results in a supplier business improving its cash flow, there are some downsides:

- The supplier business receives less than its required price for the items or services

- The lender must understand the commercial dealings of the supplier business. Also, they must investigate the capacity of the selected buyers to pay their accounts on time

- The role of the factor is disclosed to the buying company; thereby showing that the supplying business is using short term finance, rather than investor capital, to help fund the business

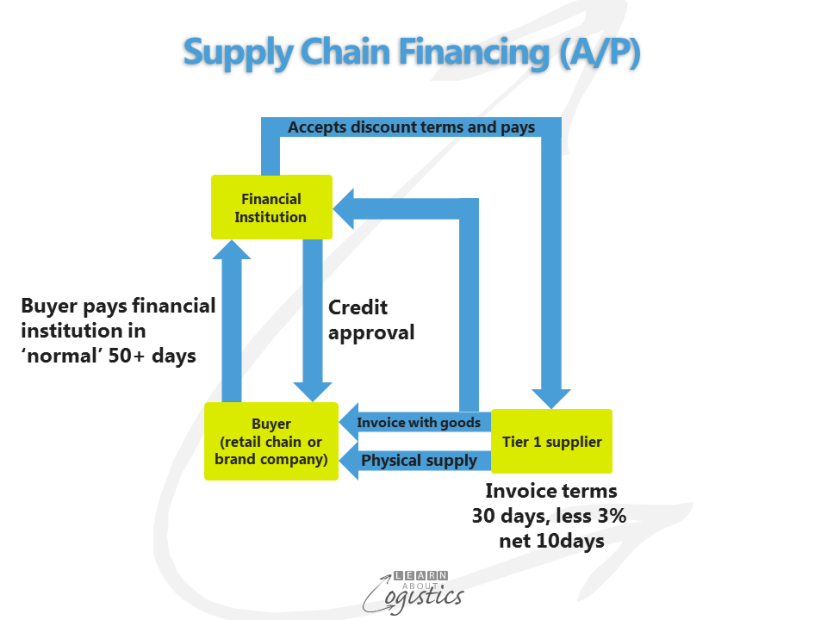

A more recent approach in SCF addresses the accounts payable (A/P) of the buyer. In this relationship, the lender works with the buyer to finance suppliers’ invoices. Although A/P are a trading liability (a debt), the financial lender is only working with one business, whose credit worthiness is known; therefore the contract relationship is simplified.

In the typical seller – buyer negotiation, the seller wants to be paid quickly, so they can fund the business. Therefore an incentive for early payment is typically offered; for example, a supplier’s trading terms are 30 days, with 3 percent discount net 10 days. However, the buyer is likely to ignore the discount offer and to help its cash flow will pay the account in the ‘normal’ 50 days (or worse).

In the SCF financial relationship, the lender will take advantage (arbitrage) of the discount offered by suppliers for early payment. In this example, the supplier is paid in 10 days, giving the finance business a three percent discount. The buyer pays the lender the full amount at the 30 day due date, or it can extend, for a fee, the payment date to the normal 50 days or more.

The advantage of this approach is that the commercial terms of the seller becomes part of the negotiation, as the buyer is providing its (typically higher) credit rating to the supplier. The cost of capital from the buyer could therefore be less than offered in financial markets. This is due to the imposition of bank fees and limits on the amount of funding provided, which increases the funding costs for smaller suppliers to multiples of the headline interest rate.

As this approach will help the supplier to grow their business, it enables the buyer to negotiate aspects of the relationship concerning supply chain visibility and co-operative scheduling. Where a supplier’s supplier (tier 2) is critical to the buyer and the financial standing of the buyer is strong, it is possible to provide supply chain A/P financing via the ultimate buyer. This provides liquidity for selected tier 2 suppliers and therefore lubricates more of a supply chain.

The third aspect of SCF is Inventory finance. Here, the lender uses the intended purchase of (typically) finished goods as collateral for a loan to cover the purchase of items. Inventory finance can be used when a supplier must be paid quicker than the time taken to sell the items and collect the sales income, such as when building inventory for a seasonal sale.

For larger MNC businesses, there can be the added profit potential of establishing an internal finance business managed by treasury. Its role is to undertake the accounts payable and inventory financing for operating divisions of the business. In addition to earning trading profit, the financing entity may be registered and operate in a low tax country as part of a region supply network hub.

To improve your supply chains, the objective of greater visibility through implementing appropriate technologies will remain. From that investment will come more reliance on SCF, which supply chain professionals need to master, otherwise accountants will do the job. However, incorporating the money flow into your supply chains will not occur unless the technology and systems investments are overseen by good system integrators and you have the people skills to carry supply chain and logistics teams into new ways of working.