Know supply markets

Surveys conducted since the COVID pandemic indicate that even well-resourced companies know the production location details of only about half of their Tier 1 suppliers, about 20 percent of Tier 2 suppliers and less than 5 percent of Tier 3 suppliers. Yet it is at these lower Tiers where the risks to supply are highest.

The ‘need to know’ about suppliers at Tiers in a company’s supply chains is due to:

- Request by a customer that is either building their own Supply Chains Network Design Map or they are required by EU law to have knowledge of their suppliers

- A need is identified within an organisation to improve understanding of the supply chains, due to uncertainties about the effects on trade lanes of geopolitics and climate change. Not understanding your organisation’s supply chains is a risk to the business

Changing trade lanes

United Nations trade data indicates that the decline in global trade of goods is coming to an end. But there are changes happening in the structure of trade. One indicator is that trade is becoming more ‘regional’, either geographic or within blocs of countries with similar geopolitical outlooks. Trade will therefore likely increase for globally concentrated products, where three or fewer countries provide at least 90 percent of global exports.

About two-thirds of global exports are by Multinational companies (MNCs). If they reorganize their business within regions, to align sourcing (from a narrower range of countries) and production with end user markets, then supply chains could alter.

And the use of terms such as ‘decoupling’, ‘derisking’, reshoring’, ‘nearshoring’, and ‘friendshoring’ has increased, concerning responses to geopolitical events. But, do not be influenced by media coverage of a situation. The consulting firm McKinsey has identified that the terms apply more in the US, which is an outlier concerning relocating trade. Other economies analysed do not show evidence of using the terms; instead their trade is likely to travel farther. Even for the US, trade is moving more to geopolitically aligned countries than geographical close countries.

Other indicators are an increasing involvement of governments to secure materials deemed critical or essential to a country’s economy. Global trade restrictions by governments in developed and developing countries have increased, including the use of tariffs and sanctions, both as a trade protection and political action. Geopolitical conflicts and climate change influence on weather (floods, droughts, storms) will disrupt shipping lanes and increase commodity prices, thereby affecting flows of global trade.

Applying these measures to countries indicate differences in trade trends between developed and developing countries. Over time, supply chain professionals recognise that changes in trade patterns (or geometry, measured by: trade intensity, geographic distance, import concentration and geopolitical distance) will affect trade lane shipping patterns, port berth availability and warehouse space availability.

Supply Markets Plan

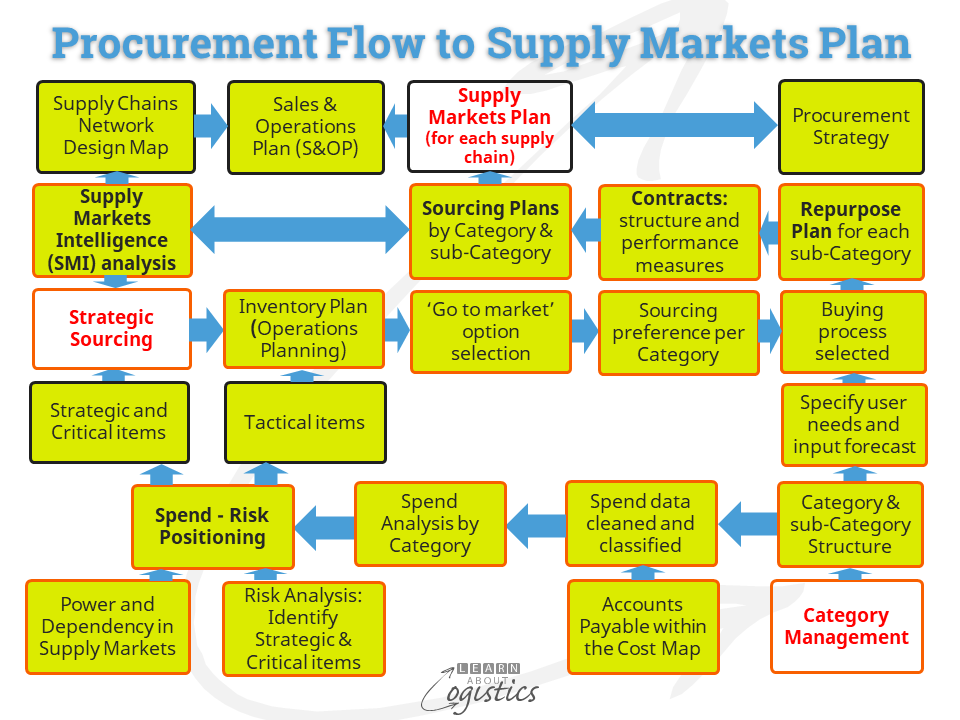

Procurement should be the organisation’s manager of external risks, helping to protect the gross margins of the business. To identify and understand the risks associated with the purchase of an item, requires Procurement to also understand the wider risks associated with the organisation’s supply markets (including trade lanes). The diagram illustrates the Procurement process Flow to establish the Supply Markets Plan:

There are two groups of activities in the model which provide inputs to the Supply Markets Plan:

- Category Management, which includes:

- Category structure which segments the purchased items within a logical structure

- Spend Analysis which evaluates the criticality of a buy, by category/sub-category and therefore the relationship required with the selected supplier(s). It relies on Accounts Payables (cleaned and classified) within the ‘Cost Map’ and is input to the ‘Risk-Spend Positioning’ matrix.

- Strategic Sourcing objective is to understand the capabilities and evaluate the competitiveness of the supply market for each category of spend.

- Inputs are the Supply Markets Intelligence analysis, Sourcing Plans and the Re-purpose Plan, which meets requirements of a Circular Economy.

Supplier knowledge task is to assess the resilience of markets and businesses, using the Supply Chains Network Design Map and the vulnerability of the business to supply of strategic and critical materials from the Supply Markets Intelligence analysis.

Products purchased domestically will include items manufactured internationally but sold domestically by country sales divisions of the brand business, importers and agents. Therefore, many global supply risks remain within domestic supply.

Also, progressively identify the suppliers (current and potential) by Tier; their risks, power and dependencies. The knowledge gained of supply markets and suppliers enables Procurement professionals to be confident and credible with suppliers

A risk that eventuates can equally affect the supply of an item costing 10 cents or $100, which can affect the business to the same extent. Therefore, identify the ‘Revenue at Risk’ of future sales that could be affected if a Procurement risk eventuates for one or more purchased items.

The Revenue at Risk identifies the financial magnitude of risks, which enables a Portfolio of approved mitigation and adaptation actions to be established within Supply Chains Risk Management process. When Procurement risks are identified, there is a choice of action: transfer, share, minimize or eliminate the risk. The better the relationship with Tier 1 suppliers, the easier will be discussions concerning how the identified risks can be actioned.

As the manager of external risks, ideally about two thirds of time and resources in Procurement should be devoted to Strategic Sourcing. Typically, however, most of the time and resources of Procurement are spent working in Operational Purchasing and Contract Management. Herein lies a major supply chains improvement opportunity.

Positioning supply chains

Because of increasing Uncertainties, sourcing from Tier 1 suppliers could see a reduced emphasis on purchase price and an increased emphasis on: location (of the supply facility), reliability (responsive or flexible), visibility of actions and sustainable processes. This would enable a business to position supplier relationships as a core strength.

An organisation needs to be positioned for Uncertainty. This requires using Scenario Planning for anticipating action and developing a portfolio of mitigation and adaptation actions. Internal and external co-operation can also be implemented as corporate policy, although it will need a change in performance measures.