An era of low-cost debt

Economies are now experiencing rising inflation and central banks increasing interest rates. Equity (share or stock) markets in some countries have experienced a reduction in the price of shares by 20-30 percent. How may these events influence Procurement in your organisation?

Since 2008 central banks in many countries have provided low-cost liquidity for their economies, keeping interest rates at close to or below zero. Governments and financial authorities are most likely to continue their rhetoric about fighting inflation and reducing government debt, while removing COVID financial support measures. If so, then business relationships with some of your organisation’s suppliers could be affected. There are four aspects to consider.

One is that low interest rates have provided financial support for companies that otherwise would not have survived. These are businesses where earnings before interest and tax do not cover interest cost; nor their liabilities to government tax authorities. The companies have survived through continuing access to low-cost bank loans that support cash flows, but business loans are now more difficult to obtain.

This new environment will be a test for these ‘zombie’ or non-viable companies. The Organisation for Economic Co-operation and Development (OECD) considers that in developed countries, about 12 percent of businesses can be identified as ‘zombie’ companies. As interest rates increase and bank loans are more difficult to secure, it is likely that corporate bankruptcies will increase.

Another aspect is that low-cost debt has assisted the growth of ‘unicorn’ (mainly technology) companies – those with a market valuation of more than U$1billion. The valuation is based on future expectations, because the majority have yet to generate a profit. The new era of lower share or stock valuations and higher interest rates may well see the demise of some ‘high growth’ companies.

A third aspect is that more expensive money will result in suppliers becoming less willing to provide their customers with extended payment terms. Except if your business is a monopoly or duopoly buyer for an item, be prepared that payment terms of 60 days (and higher) will not be available, because if they continue, suppliers will not survive to provide any supply. This could change working capital requirements at buyer companies.

As access to low-cost money diminishes and some suppliers become bankrupt, there is an increased need for Procurement to understand the relevant supply markets for their purchased materials and intermediate goods. Although often difficult to achieve, try to go beyond tier 1 suppliers and identify tier 2 and 3 suppliers (and their suppliers) that could be in a weak financial or operational situation.

The fourth factor for Procurement professionals to consider, is that suppliers are likely to want an increase in price, to cover for inflation cost increases. If a supplier can exercise power in the relationship, they may just impose a price increase. When informed by the supplier of an imminent price increase, the most common reaction from buyers is to order an increased amount at the existing price. This could be just the reaction the supplier wants, to clear old stock!

Convince the buyer about a price increase

If a supplier recognises that such a direct approach may be counter productive, they may take time to ‘condition’ the buyer. Given that inflation in developed countries is currently in the range of 5-9 percent, obtaining a price increase of 20 percent would appear to be unachievable. However, a well structured sales plan can meet this objective.

The main task is to convince buyers that the supplier is experiencing very high cost increases for its business inputs. To achieve this, meetings are arranged between the supplier and buyer concerning future requirements (as a cover, the meeting is justified for ‘planning purposes’). Here, the supplier will ‘open-up’ about their cost problems, but a price increase will not be requested. There could also be invitations for buyers to attend sporting events or other occasions that have an interval period, when the supplier representative can raise the topic of cost increases. To support the campaign, emails and messages are sent to buyers with links to articles that support the supplier’s case concerning cost increases. As time goes on, the supplier will more often use examples with cost increases of 30 percent (or more). As the supplier has discussed increased costs for some time, the figures will not be surprising to the buyers.

It is only after some weeks or months that the buyer is informed that the price will increase by (say) 24.5 percent (the decimal point shows that the price increase has been ‘carefully calculated’). Due to the message that has been delivered over the ‘conditioning’ period, buyers will be relieved that the increase is less than expected.

In a study of this approach by Steele and Court in the mid-1990s, they found that 60 percent of 300 buyers accepted a similar price increase or even more, having previously signalled an understanding of the supplier’s cost problem. Although some customers were able to negotiate a lower increase, the supplier achieved its objective of an average 20 percent price increase.

Many buyers had not realised that the negotiation period had started when the supplier first contacted the buyers to inform them about cost increases. By the time a price increase was announced, buyers believed there was was little they could do to change the situation.

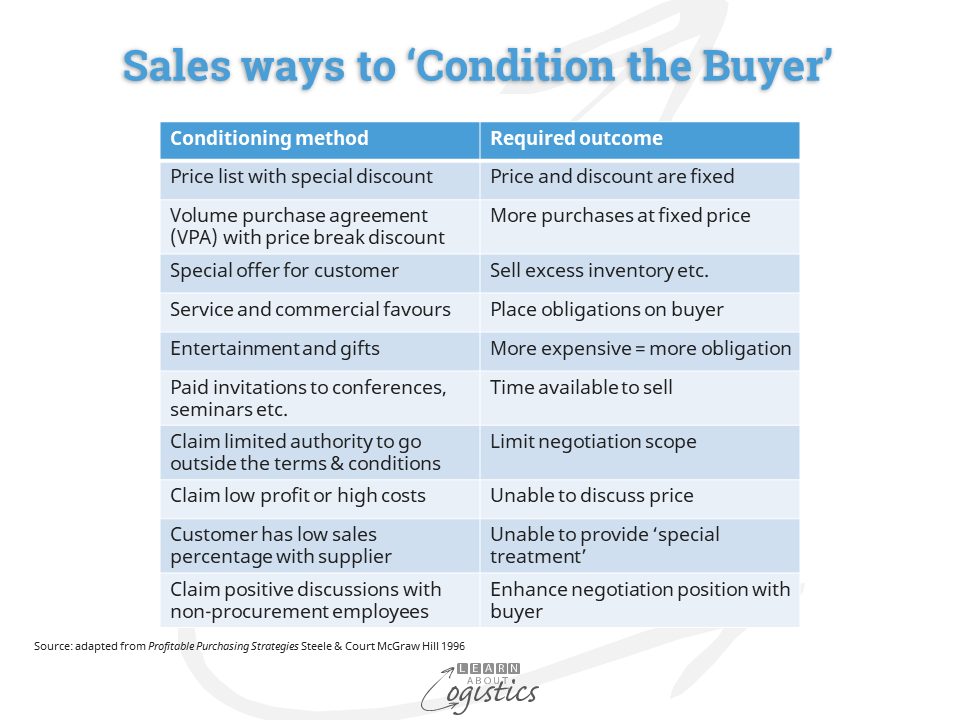

The table below lists some of the Sales techniques to ‘Condition the Buyer’, also called ‘buyer conditioning’, whereby supplier sales staff work towards buyers behaving in a required way.

Conditioning often works because because its aim is to prepare the buyer’s mind for a certain outcome. Achievement occurs because the actual outcome is not as bad as expected. They ignore the sales process. Of some relief to Procurement professionals is that few suppliers have sales management and staff that are skilled in implementing the different techniques. In business degree courses, Marketing is often a compulsory subjects, but rarely is Sales discussed. Therefore, many undergraduates that enter the workforce in a sales role have a limited understanding of selling and this is made worse if their employer is driven by sales quotas and bonuses, with the ‘ABC’ approach – ‘always be closing! However, be aware that the techniques may be used and to counter them, Procurement must take control of the relationship, to ‘keep the seller selling’.