Uncertainty comes before risk.

Measuring the performance of your Supply Network is likely to become a requirement of the board and senior management in enabling the required levels of service for customers and consumers. It is also likely to be an increasing requirement of insurance companies.

The financial measures for supply chains are discussed in my eBook Supply Chains Operating Performance – A financial approach to measurement. The diagram within the blog of May 9 identifies the three objective measures of supply chain operational performance: delivery performance (DIFOTA), availability for customers (S&OP) and uncertainty minimisation (risk). This blog discusses the third operational measure, that of uncertainty minimisation.

Over the past forty years, changes in taxation rules, investor expectations, communications capability and transport infrastructure has driven a range of responses by many businesses in developed countries:

- Outsource non-core functions and contract out individual activities

- Source globally for materials, parts, components and finished products

- Locate production offshore in low cost countries (LCC) and

- Increase the number of stock keeping units (SKU), to provide product differentiation across smaller market segments

Through implementing these changes, Uncertainty has increased in organisations across four dimensions:

- increased reliance on a global spread of suppliers within the supply base

- increase in the number of tiers (levels) of suppliers

- increase in the number of direct (tier 1) suppliers in the supply base

- increased lead times for items, requiring increased levels of safety inventory and cost

These eight factors can interact and amplify each other, which can increase the likelihood of disruptions in the effective and efficient supply and distribution of items. When the processes of sourcing, operations planning and logistics are extended across national borders and across layers of suppliers in different industries and countries, then Uncertainty increases, both internally in the organisation and externally across its Supply Network.

Structuring Supply Chain risks

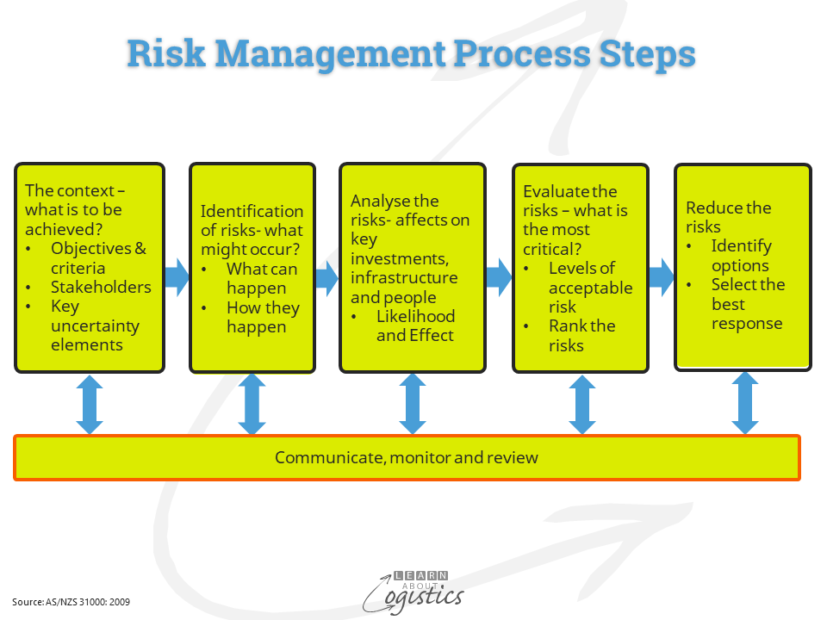

The multiple Uncertainties for an organisation’ Supply Network need to be understood for their potential severity on the business and the effort and cost required to mitigate the effects. This is Supply Chains Risk Management, with my definition being: ‘The structured identification and assessment of uncertainties that provide potential risks within an organisation’s supply chains and the development of mitigation approaches to avoid or minimise the consequences’ . The diagram provides a general overview of the risk management process.

But, a major barrier to implementing a Risk Management regime is that of time – should a supply chains team spend time structuring a risk plan for events that may never happen? My recommendation is that a Supply Chains Risk Management plan is an essential part of your Supply Network Design and will be increasingly be demanded by boards of directors and insurance companies.

Managing Risks is an investment in future events; it is therefore preferable to anticipate potential risks rather than trying to overcome unexpected challenges when they occur. However, the greatest risk is that an organisation remains in reactive mode and only responds when something goes wrong. Not investing in processes, techniques and technologies to protect against anticipated risks in an organisation’s Supply Network is not an effective cost saving.

Risks between supply chains differ, depending on industry and geography. However, there is a standard matrix approach to structuring the risks; the first step is to classify potential risks; the second step is to place the risks in identifiable categories:

Classification of External and Internal risks, with examples:

- External risks that arise from interactions between a supply chain and its wider environment:

- Natural physical risks (hazard risks that may be insured)

- physical shocks e.g. earthquakes, volcanoes

- Climate risks (Insurance companies may become more reluctant to cover these risks, as they are influenced by human activity)

- Adverse weather conditions (e.g. droughts, forest fires, storms (cyclones, typhoons and hurricanes) etc. that can be attributed to global warming

- Environmental and Sustainability risks. Examples are:

- how the ‘re’ terms e.g. recall, repair, returns, recycle, refurbishment and re-manufacturing may affect your business, especially if mandated by government

- consumers who buy becoming users who rent – the effect on supply chains to handle multiple recycles

- industry specific regulatory changes e.g. emissions standards; use of eco-friendly packaging

- availability and price of utilities (water, gas and electricity) and the efficiency of their usage; includes the purchase or installation of renewable power

- Geopolitical and Sovereign (country) risks

- the recent increase in Geopolitical events, especially Geo-economic ‘the deployment of economic punishments and rewards to coerce nations to adopt preferred policies…Can apply to any country that is economically powerful (globally of within its region) and integrated into the global or region economic system’ (US Council on Foreign Relations)

- Economic and Market risks

- identify the needs of a changing consumer society e.g. the origin of products and ingredients (‘clean and green’) and labour working conditions through supply chains

- changes in telecommunications and the potential of disruptive technologies i.e. the potential introduction of Blockchain technology transactions flows within supply chains

- Natural physical risks (hazard risks that may be insured)

- Supply network risks within inbound and outbound supply chains:

- Network risks: enhancing brand value, increasing profitable revenue and reducing the cost of doing business

- Industry risks: community licence to operate by country, availability of items and financial viability of suppliers

- Cyber attack risks of events that can affect the operations of a supply chain

- Internal (enterprise) risks are related to potential uncertainties in the execution of an organisation’s supply chain strategy

- Supply chain process risks identify an inability to achieve consistent outcomes relating to planning of materials and resources and deliveries of products or services

- Risks within Procurement

- Risks within Operations Planning, including subsequent Quality and OH&S risks

- Risks within Logistics

Risks identified under 1.1, 1.2 and 2.3, are events that occur within a relatively short time span and could affect business viability. They come under the heading of Business Continuity risks, which require businesses to implement some resilience against the possible consequences.

Risks can change quickly within each of the four classification groups. This highlights the need to understand the changes to levels of risk that can affect your organisation’s supply chains and the supply chains of suppliers and customers in many countries.

The factors noted in this Classification list can also be present through your supply network; but with an added factor – the inter-connections between industries. That is, how events in one industry (or company) can randomly affect demand and supply factors in other industry sectors that supply your business – these are the emergent results of a complex adaptive system, called your Supply Network. The next blog will discuss placing the identified risks into categories and so provide a matrix structure for decisions about analysis and risk mitigation.