Understand suppliers

Supply Chains cannot be managed. Instead, the role of supply chain professionals is to understand supply chains and the likely actions of suppliers and providers of supply chain services. But what does ‘understand’ mean?

It relates to understanding the likely behaviour and response of businesses to unplanned occurrences in their supply chains. How much the responses are likely to affect the operations of your organisation’s supply chains is dependent on whether the business is a Tier 1 supplier, plus two factors: the: risks that may influence the buyer and a supplier and the power that the supply business is able to exert in a supply chain, or the dependency it has on customers and supply chains

Risks in supply chains

Identifying, analysing and managing risks in supply chains must be a core capability of the Supply Chains group (Procurement, Operations Planning and Logistics). But the approach to the task is guided by how senior managers view risk in relation to the business; summarised as:

- Risk appetite: the amount and type of risk the organisation is prepared to pursue and accept and

- Risk tolerance: the capability of the organisation to withstand the effects of the risks undertaken

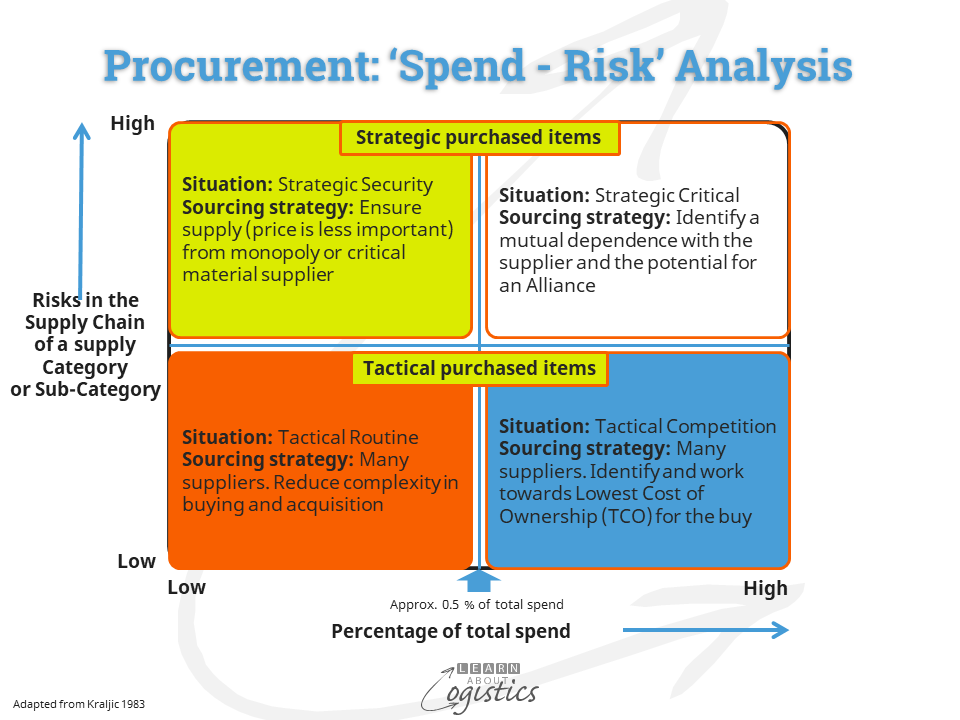

As shown in the diagram for the buying organisation, the two factors to be matched are the volume of Spend for the supply Category/sub-Category and the associated Risks.

Consider the risks under four main criteria:

- Supply Chain Network Design risks within the ‘Core’ and ‘Extended’ inbound and outbound supply chains. There are a wide range of risks to consider e.g.

- Availability and Vulnerability of supply for a Category/sub-Category

- Outsourcing and offshoring: transparency, response times, security and intellectual property

- Cyber-attack at your organisation, customers and suppliers that can affect communication, data integrity and operations within your organisation’s Supply Chains

- Reputation impacts for the organisation if a supplier at Tier 4 in a supply market uses child labour

- External risks to the supply chains from interactions between a location (inventory Node or transport Link in a supply chain) and the wider environment.

- Risks are summarised under the acronym of PESTEL: (Geo)-Political; Economic; Social; Technological; Environmental (i.e. ESG); Legal

- Internal (enterprise) risks to the supply chains e.g.

- Multiple supply chain risks (connected risks) are not brought together, due to the lack of cross discipline knowledge

- Internal Supply Chain process risks that constrain the business from achieving consistent outcomes relating to planning and scheduling the movement and storage of materials.

- Risks within Procurement

- Risks within Operations Planning

- Risks within Logistics, including OH&S risks

For items in the Tactical Routine and Tactical Competition quadrants, a portfolio approach to the risks is used. Total the commitments for each item by region, country, city and supplier and identify possible contracts that could increase the Cost to Serve, such as:

- compete for capacity resources at suppliers and 3PLs

- affect deliveries of other items

- be affected by disruptions at transport facilities (sea and airports)

As the risks increase, so a supply Category or item becomes more critical to the buying organisation. For items within Strategic Security, the sourcing strategy is to ensure supply and for Strategic Critical items it is to build mutual dependence. To identify how critical the item is to the organisation, analyse Availability and Vulnerability.

Availability of supply: Supply Chains can be disrupted by geopolitical events, with the imposition of import and export bans, tariff and non-tariff regulations or quantity quotas. Also, trade regulations concerning import and export duties, dumping and embargoes, plus technical regulations affecting building permits for suppliers and IT interoperability with suppliers.

Vulnerability of supply: The potential of Tier 1 suppliers having a raw material in short supply or unable to obtain sufficient intermediate items from their suppliers.

- Company reliant on a few suppliers or the potential suppliers are located in the same geographic area (concentration of supply risk)

- Price fluctuation likelihood

- Country Strategic Dependency: a country imports a particular good (or item) available from less than three exporting countries; or more than 50 percent of the country’s supplies come from any one country and that country controls more than 30 percent of the global market for that particular good (or item).

- Economic importance of the item in the development of future products and technologies

- Substitution or new production technologies – how likely

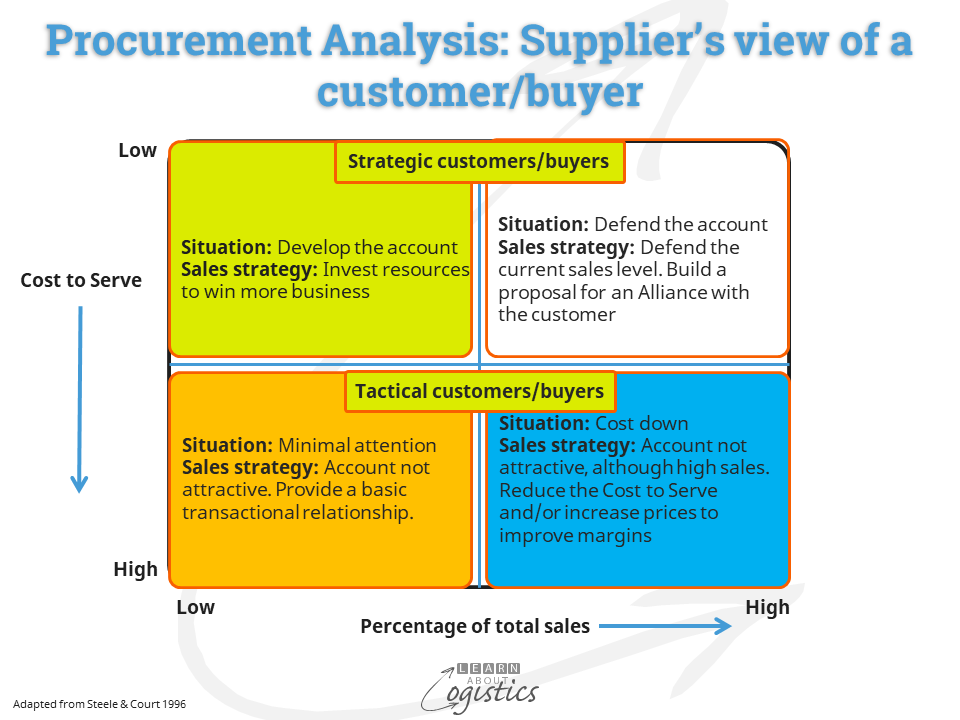

Having completed the Spend-Risk Analysis, Procurement then reviews potential suppliers’ likely views about a supply relationship. This is an application of Game Theory, whereby the Supply Chains group at the buyer take the role of sales staff at the supplier. The two criteria for consideration are the percentage of total sales that the supplier has (or may have) with the buyer and the likely Cost to Serve the buyer.

Match the quadrants

The most preferable response of a supplier is to mirror the buyer’s needs. For example, if the buyer has placed office stationery as Competitive Routine (Spend-Risk quadrant 1), the ideal match is that a supplier views the buyer as core business to defend (Supplier Positioning Quadrant 4). In this situation, the supplier will provide a high level of customer service under a period contract.

Conversely, challenges will occur for the buyer if they are viewed as Minimal Attention (Supplier Positioning Quadrant 1). Neither the buyer or supplier will put resources and effort into the contract, so the business relationship is likely to be acrimonious.

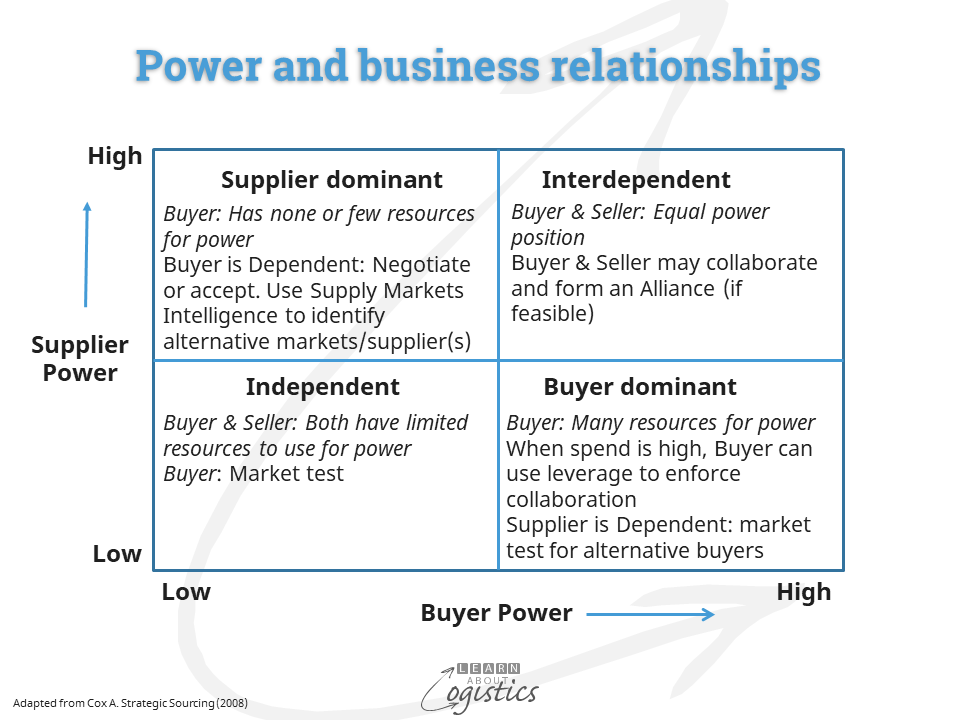

In addition to assessing the risks through supply chains, the Supply Chains group must identify at which inventory Nodes and transport Links in the Network does the exercise of Power and the need for Dependency have a role.

These may affect the response to a disruption, such as the allocation of scarce materials. or a powerful customer can unilaterally extend the payment terms. In these situations, suppliers in a competitive supply market must accept the new situation, but those supplying items in a monopoly/duopoly situation will be treated differently.

The game of modelling buyer-supplier risk and power positions can be played for each supply Tier through the supply chains. As the quality of data and information improve, the results are better the more often that the game is played.