Preparing for the next one

The likelihood of another virus, but with unknown reach and consequences is very high. It may occur in two years or twenty years, but it will happen.

Business and supply chain models for the future should assume continuing disruptions (both man made and natural) and build Resilience. To achieve this requires the Supply Chain strategy to be both dependable and agile (flexible and adaptable) for processes and people.

But change across an organisation or industry and along supply chains can take a long time. This is addressed in a recent report by Richard Wilding, Professor of Supply Chain Strategy at Cranfield University UK as the lead author and published by DHL. The report is of value for supply chain professionals as it is without hype and buzzwords.

The report states that before there is a ‘new normal’ for supply chains, there will be a transitional period that will affect different countries, industry sectors and businesses over variable time lines and with different emphasis. As this transitional period could be as long as 10 years, strategic plans for supply chains should evaluate a range of factors for building scenarios.

Recovery by country

Countries with an approach of ‘go early and go hard’ have come through the pandemic better (at least until August 2020) than countries with a more open (or no) policy.

Countries with the services sector as a major part of their economy could take longer to recover. The most affected part of services – travel, hospitality, public entertainment, discretionary retail, sports events and arts is likely to be 30-40 percent of all services.

But, specific factors can change the outlook for a country. For example, Australia and New Zealand have a predominately services economy, yet about 75 percent of their exports go to East and SE Asia. This region will have an economic contraction of about1 percent, rather than the 5 percent contraction expected for the world.

The Capacity Recovery Index by Veisk Maplecroft has used a number of factors to assess the capability of G20 countries to recover from the pandemic. The Index considers that Western Europe and East Asia have the best opportunity to recover economically, but it will be most difficult for India, Brazil and South Africa.

Supply Chain Scenario factors

As individual countries will have different rates of economic recovery, so it will be for each organisation’s supply chains. The DHL report considers that priorities for a Supply Chain review are:

- resilience of the supply chains

- customer location and proximity

- demand patterns

- sales channels

- supplier location

Also, the report recommends that you know your organisation’s: cost drivers, actual customer demand (which differs from sales), service level and value density by product group, product line and SKU. Also, establish the trade-off between lead times, logistics costs and risks.

Supply Chains

- Global trade and therefore goods movement activities could be affected by increasing protectionism by countries

- Resilience may require relocated production and distribution facilities

- Develop a risk profile of each supply chain and the cost/benefit of resilience decisions

- The reliance for supply on particular countries could be reduced

- Less reliance on single source and single factory

- Promotion by governments and vested interests of re-shoring and near-shoring manufacturing businesses

- Potential price deflation for offices, retail centres (malls) and city retail; hotels and other travel related activities (which could rebound within five years). Could also be in housing and therefore affect household goods – whitegoods and furniture, although with reduced international travel, expenditure on household goods could increase

- The level of individual savings and accumulated ‘stuff’ – each is a buying decision that affects supply chains in consumer societies

- The transitional phase is likely to be a period of economic recession. Demand will be variable and the view of forecasts as ‘the future will be like the past, plus a bit’ will not prevail:

- High levels of unemployment in developed countries

- Travel, hospitality and entertainment sectors under major change

- ‘Work from home’ policies. Offices reconfigured for a low percentage of staff to attend at any one time

- Central hub and spoke (decentralised) office locations. Staff work from small offices closer to home – less commuting and requirement for public transport and cars. Reduced consumption of energy

Logistics

- Multiple and smaller warehouses, located closer to the customer but with higher inventory holding costs

- Changing transport: point to point direct sailings between a limited number of ports, with connecting coastal shipping, rail and road connections to the final destination. Increase in rail between Asia and Europe

eCommerce costs

Much has been written about the increase in eCommerce transactions during the pandemic. But what of the future if costs increase?

- Retailers are finding that eCommerce has increased their ‘cost to serve’. Their business model may be modified and/or they will invest in technologies to improve sales margins

- For cross border buying by individuals, eCommerce costs will increase. Postal rates may substantially increase in the US for small parcels from Asia; also, the EU will charge VAT on all incoming packages

- The courier, express and parcel (CEP) sector has seen a rebalance between B2B and B2C volumes in favour of B2C. Prices could increase, as delivery efficiency is reduced with B2C

Changing skill sets

The DHL report recommends that managers working in supply chains develop appropriate skill sets for themselves and their staff to implement and operate new work practices.

- In developed countries, with high labour costs and a possible shortage of logistics manual labour, the emphasis will be in automation and robotics

- In developing countries with low labour costs and an available supply of logistics manual labour, the emphasise will be in analytics:

- Descriptive: explanation for success or failure in the past

- Predictive: enable decisions through analysing ‘big data’ within and between connected devices and

- Prescriptive: data supported options provided for evaluation and decision

In its ‘The Future for Jobs’ report, The World Economic Forum (WEF) provided a view of the top 10 skills required for 2020. However, this order could change post-COVID 19. Consider your organisation and its supply chains to re-order the top 10 skills list:

- Complex problem solving

- Critical thinking

- Creativity

- People management

- Co-ordination with others

- Emotional intelligence

- Judgement and decision making

- Service orientation

- Negotiation

- Cognitive flexibility

Transition phase activities

The DHL report recommends the following supply network activities within your transition phase:

- assess the organisation’s disruption plans for their effectiveness

- better understand the activities and capabilities of suppliers below tier 1

- understand the flows in your organisation’s supply network

- consider options to reconfigure your supply network

- drive automation and digitalisation (“The use of digital technologies to change a business model and provide new revenue and value-producing opportunities” – Gartner)

- reassess distribution channels and warehouse locations

- map nodes in the supply network and quantify (not value) the inventory by raw materials, intermediate and finished goods

- build a collaboration mindset. Requires the prior development of co-operation and co-ordination between internal and external parties

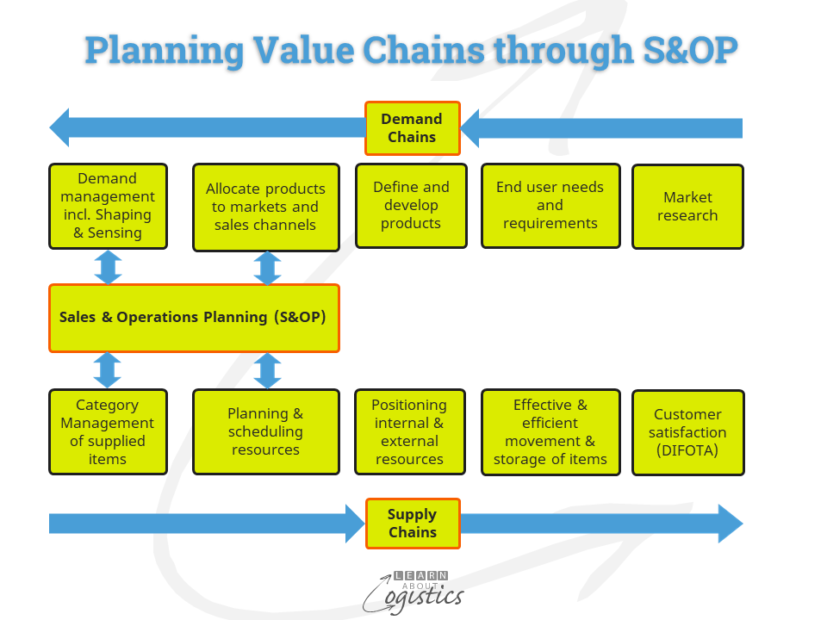

In addition, place an emphasis on the implementation of Sales & Operations Planning (S&OP).

Few organisations have implemented S&OP or those that have are limited in its use. To be resilient, requires that your organisation cease planning in isolated cells, but instead uses ‘one plan’ to provide the base for effective and agile operations.