Value in Supply Chains

A recent article that discussed value in supply chains, illustrated the ongoing challenge of using definitions in supply chains that all can agree. If basic definitions like Value Chain are inconsistent, then what hope is there for agreement on the multitude of new terms and ‘buzz words’ used in supply chains?

Value of a business is defined differently by investors, customers, suppliers, employees and other stakeholders. At the corporate level, value involves identifying and understanding the stakeholders relevance and importance to the organization and assessing their expectations.

At the business level, providing value for customers and end users is a key objective. But the objective is to maximise the Value Added; that is the amount that customers are willing to pay for the product above the total cost of purchased items and services. This is a measure of the contribution to the business by all employees.

To achieve these objectives, businesses identify end-user needs and attempt to satisfy them with products and services. End-user satisfaction is obtained through providing availability of the products and services. In current business language, these are Demand Chain and Supply Chain, with an organisation typically having between five to nine supply chains, defined by materials, processes or constraints..

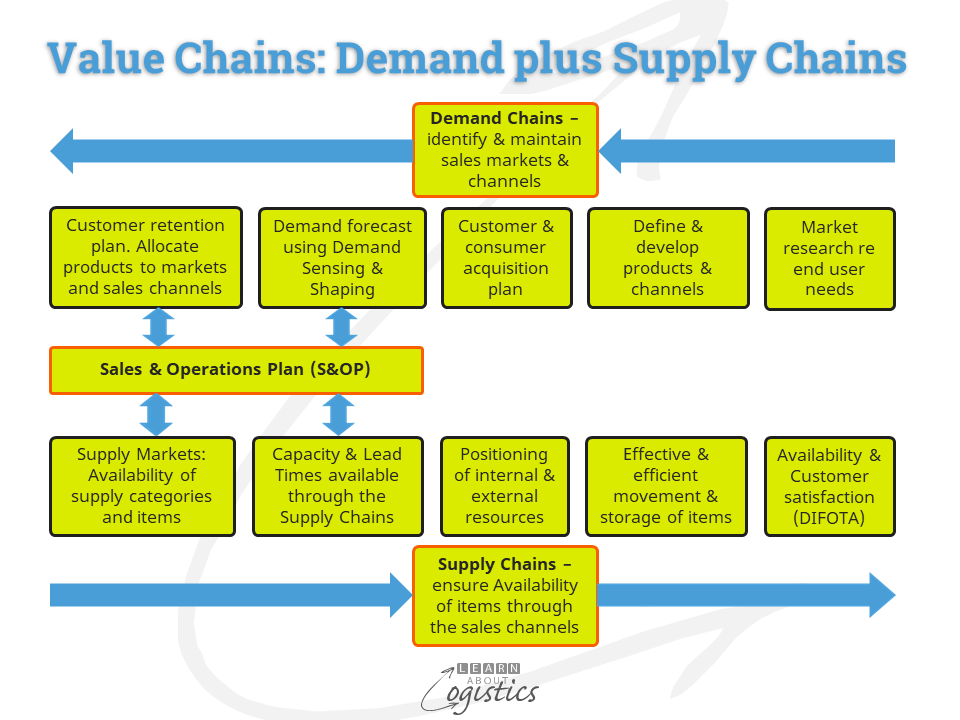

Both chains add value for the organisation and together provide the Value Chains of the business. The Demand Chains from product idea to the finished product and customer support and the associated marketing and sales campaigns. The Supply Chains from purchased materials to finished products that are available for purchase by customers. This is illustrated in the diagram

Providing Value

The term ‘supply chain’ was first mentioned in the early1980s and began its acceptance in business about ten years later. The definition of supply chain used by Learn About Logistics is:

The effective flows of items, money, transactions and information between an organisation and its supplier and customer enterprises, through ‘activity nodes’ and ‘movement links’, to provide value for end users at the lowest total cost.

Each supply chain has their ‘core’ supply chain, comprising the business and its Tier 1 suppliers and customers. Then the ‘extended’ supply chain comprise interactions between Tier 1 suppliers and customers with the Tier 2 and so on. Each supplier and customer interacts with their other suppliers and customers, but these business relationships are often unknown to the focal (your) business.

The Supply Chains group adds value through improving the attributes of time and place. Time utility is

- reducing the process time from receiving to delivering a customer order

- minimising the time for all upstream steps in a supply chain to reduce inventory and the total cost of ownership (TCO)

Place utility is:

- making products physically available to serve current and potential customers

- the location of facilities – distribution centres, warehouses and factories

- customer service in relation to an an after-sales service parts service, the provision of technical assistance and an available, easy to use and informative website

In the 2000s, the term Demand Chain came into use. This defined the linked activities by Marketing, Product Development and Sales to identify and satisfy end user needs for an organisation’s products and services. A Demand Chain, is defined by the market segment in which the product(s) competes, typically the product type, customer type or sales channel. There are four broad product industry types, each with their own Demand Chain processes:

- Consumer packaged goods (CPG), identifies by ‘use by’ dates. These including short shelf-life and cool handling (chilled and frozen) products;

- Fast moving consumer goods (FMCG) are durable products, including electronics, household products and apparel;

- Asset intensive products (e.g. oil & chemicals, metals processing, pulp & paper) and

- Engineered products, including automotive & transport, aerospace and medical

Cooperation to Collaboration

To maximise the Value Added in your business requires the willingness of people to co-operate between the Demand and Supply Chains. To co-operate requires shared data and information, which in-turn requires internal co-ordination. Shared data facilitates collaboration between functions to build relationships and develop joint policies. This provides the basis for an effective Sales & Operations Planning (S&OP) process that links the Demand and Supply Chains to maximise the Value Added.

The main challenges in the S&OP process involve four critical elements of Supply Chains: supply, lead times, inventory and capacity. Discussions between the Demand and Supply Chains teams about these elements must be done holistically, because as one element changes, it can often affect the others. To better reconcile differences requires that the four elements are the responsibility of a unified Supply Chains group (Procurement, Operations Planning and Logistics).

For both Demand and Supply Chains, their respective user and supplier markets cannot be managed. In an organisation’s network of supply chains, each Node and Link responds to unplanned events in its own way, which makes for complexity. The more Nodes and Links, the more complex the system, which increases uncertainty (risks) through the supply chains. To be effective in Value Adding, Logisticians must reduce the risks associated with complexity, variability and constraints in processes.

From linear value to circular value

Most businesses have a linear business model, based on an approach of ‘take, make, dispose’. That is: buy and use virgin materials, sell an item, use the item, throw the item away. With climate change affecting business models, the model will, of necessity, change to a ‘circular economy’.

This will change supply chains from linear to circular, where the terms recycle, repair, refurbishment, re-manufacture and reuse have the same importance as the current one-way flow. Marketing will have to consider the number of iterations a new product will have through its life-cycle, requiring collaboration with the Supply Chain group to identify challenges and opportunities. The ‘circular economy’ will assist in developing the concept of a ‘Value Network’ for a business, but the criteria for measuring Value Added will have to change.