Change in CPG companies

Are disruptions to supply chains just caused by geopolitical, climate and natural events, because these can influence supply chains relatively quickly? What about changes to supply chains that are caused by changes within industries, that can take longer to be felt?

An example is the Consumer Packaged Goods (CPG) industry, where products often carry a ‘use by’ date. CPG companies are usually considered as ‘Marketing driven’, so when there are changes in consumer markets, major change in a business can be led by ‘Product Portfolio Re-balancing’. This process reallocates invested capital to higher growth and lower risk market segments which is obtained through divestments, mergers, and partnerships for divisions and product segments. And if the businesses are large multinationals, the changes can influence global supply chains.

Changes at Nestle

A recent example is the recent announcement by Nestle (with major product categories of coffee, nutrition, pet food and confectionery) that it is ‘separating’ its underperforming global water category into a standalone business. It is “open to potential partnerships or a spin-off to private equity”. A similar announcement was made earlier in the year by Unilever, that it planned to ‘spin off’ its global ice cream category business and is willing to sell weaker brands. These types of announcement affect a company’s supply chains, as the new business no longer has synergy with suppliers to the old business. New contracts are required. Also at Nestle, there were additional announcements:

- Reduce the number of operating regions to three for a “leaner, more agile organizational model”. The regions are greater Europe, the Americas (merged North and South America units), with its leadership based at Swiss headquarters and Asia, Oceania, and Africa (AOA), which includes greater China.

This decision is of interest to supply chain professionals. Leadership of the Americas region to be placed in Switzerland, especially if that includes supply chains, could be a challenge, with many video calls. Also, the enlarged regions do not appear to have a symmetry. As noted in an article by McKinsey, the share of consumer preference in North America leans towards eCommerce, but it is big warehouse formats in South America. Across continental Europe it is the private labels of discount retailers (e.g. Aldi), but it is eCommerce in the UK. And in the AOA region (Asia, Oceania, and Africa), the flows of materials, intermediate goods and finished products can be very different in many of the countries.

However, although commentators identify ‘regionalisation’ (smaller market focussed regions) as a trend for businesses, the announcement by Nestle toward more centralisation would have required extensive analysis. This illustrates that your business should make changes for its own reasons and not because of a consultant’s recommendation or that ‘other companies are doing it’.

2. The changes in Nestle will be funded by reducing costs, including reductions in inventory. Have we heard this before? No mention was made of improved supply chains planning processes. Managing inventory is more than reducing volumes and costs. Logisticians must understand how inventory levels are affected by management decisions and business interactions with customers and suppliers. Examples are:

Sales targets: The target requires a pre-build of inventory at additional cost and effort, with the ‘end of month rush’ to meet targets (and collection of bonus). This requires a build of inventory and a ‘rushed’ end of month output from factories and suppliers. When the inflated sales do not happen it is Logistics that carries the cost of holding inventory.

Sales promotions: Price promotions (or other offers) require an inventory build. National promotions are known in advance, but promotions for a product line in a state or province can happen without a trigger to increase inventory and so require unplanned deliveries.

Advertising decisions: If advertising a product prior to a normal peak in consumer demand, such as Christmas and Chinese New Year, the peak will become higher (created seasonality), with earlier orders and receipts of imported items or components.

Payment terms and payment time discounts influence inventory, as customers place their orders to take advantage of the payment time and discount for early payment.

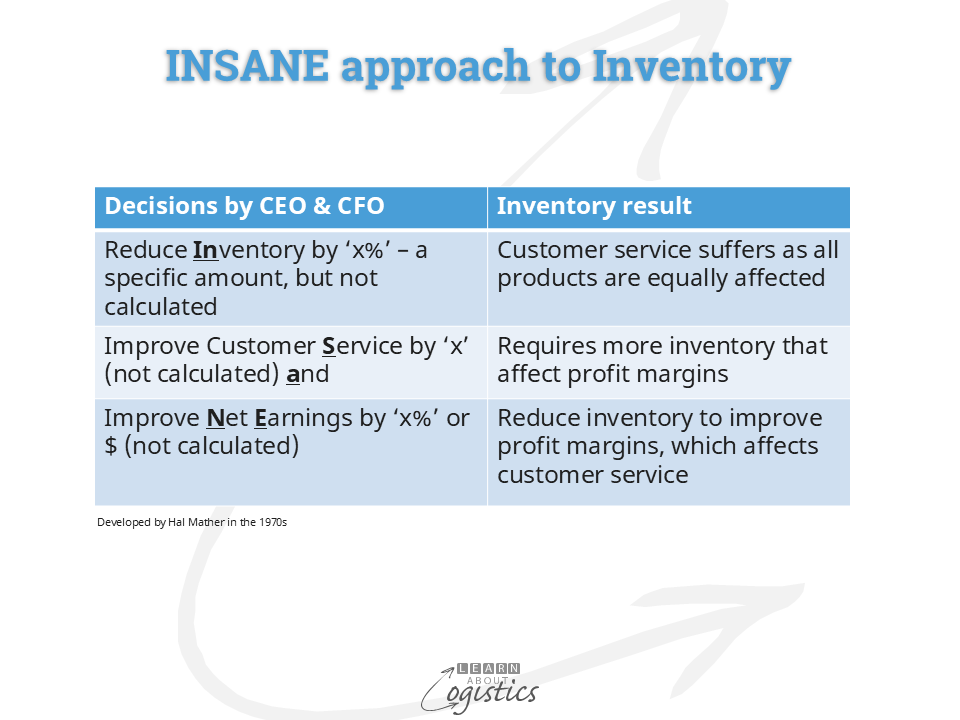

And importantly, analysis to establish the ‘right’ levels of inventory that identifies whether the company is willing to finance the calculated level of inventory. Instead, in too many businesses, inventory is viewed by senior management as a financial item (inventory is an asset in the Balance Sheet), and so have objectives that are financial rather than physical. This leads to announcements by the chief executive of the INSANE type, shown in the diagram below. This was identified 50 years ago, so the scenario is not new.

In addition, the main disciplines associated with a company’s supply chains (Procurement, Operations Planning and Logistics) are often not aligned within a group. Instead, each discipline has its own reporting line, with a focus on low cost and ‘efficient’ operations, which can include long production runs to obtain reduced unit costs.

3. Initiatives in Procurement were stated, but not identified. However, experience tells us that if initiatives in Procurement is a part of reducing costs, then Purchase Price Variance will be the figure that Finance will focus on – to the detriment of longer-term initiatives concerned with reducing the total cost of ownership (TCO).

4. Nestlé also stated that it “will accelerate its digital transformation to be a real time, end-to-end connected enterprise, powered by data and artificial intelligence”. Statements like this send shivers through supply chain professionals, because planning (as opposed to scheduling) supply chains does not require an ‘end to end connected enterprise’. Similar statements have been made by other companies, but they did not lead to improvements in the business. Likewise, Nestle’s earlier project involving IT integration was not successful. Could this be due to purchasing decisions being IT system driven, rather than driven by business needs and processes?

Serving customer’s needs and being effective and profitable are not mutually exclusive, they are equal. Although objectives and targets are important when experiencing change, the critical areas to consider are improved flows through supply chains and collaboration between discipline groups in planning operations. This was not mentioned in the documents released by Nestle.