Procurement strategy varies

The disruption experienced in the recent past highlighted that complex supply chains can delay the planned introduction of new products, shipping schedules can (and do) change at short notice so that lead time are doubtful and the total cost of ownership (TCO) becomes difficult to calculate. However, within the new terminology of flexibility, resilience and sustainability there may be beginnings of change in upstream supply chains concerning where and why to source items.

A report titled ‘A generational shift in sourcing strategy’ indicated that as the size of a business increases, so it will source more items globally. This is most likely for companies as annual revenues go above U$1b. It becomes less likely for businesses with revenue between U$1b and U$250m and lower again for companies with revenues between U$250m and U$50m. When revenues are lower, more items are purchased domestically, although these could include items manufactured internationally but sold domestically by agents and importers.

Because companies with lower revenues have more buying relationships with domestic based suppliers, they are less likely to change their sourcing preferences. But larger companies are more likely to change suppliers based on a reduction of risk, due to increased flexibility and improved access to purchased items.

The report also notes that the continent where a business is based influences the sourcing strategy. Companies based in the US are more likely to source items from outside the Americas, and therefore can experience more disruptions to supply; companies based in Asia are the least likely to source from outside their region.

Where a product or intermediate good has been outsourced to a contract business or contracted to a company owned facility, there is likely to be a lower urgency for change of supplier. This is due to the steps required taking longer, plus the possibility of additional (and unknown) costs. However, there should be a continuing emphasis on outsourced contractors to comply with sustainability requirements and trade agreements.

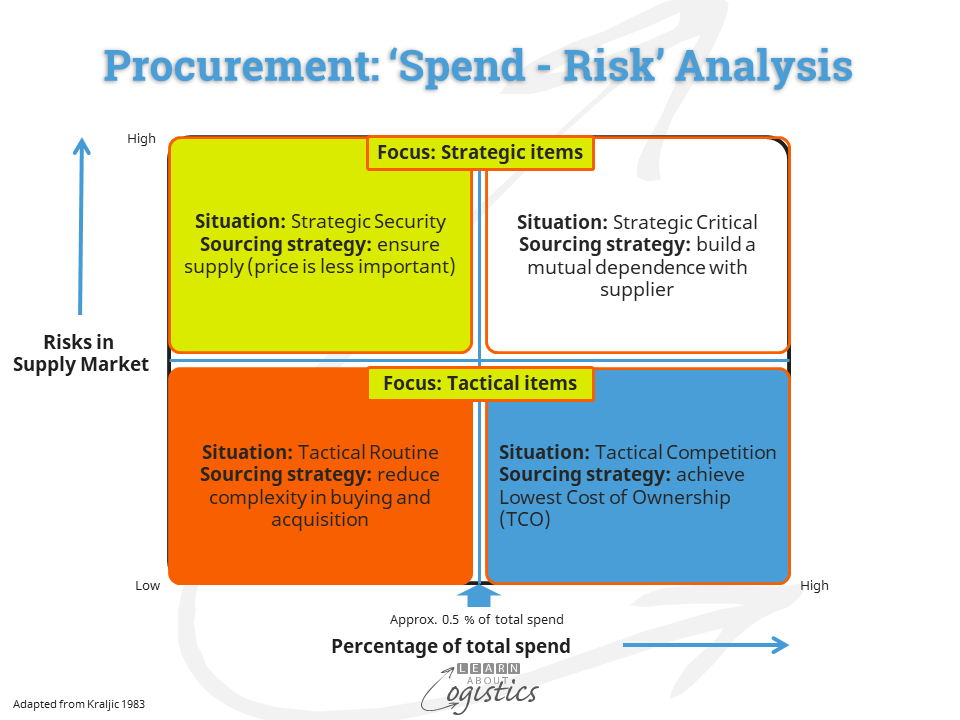

Because of uncertainties, the emerging approach to sourcing of items is likely to be a reduced emphasis on purchase price and an increased emphasis on the group of requirements that comprise: flexibility, location (of the supply facility), reliability, sustainability and visibility in the core supply chains. Within a product group, the purchased items that are critical and high risk could be less than five percent, as shown in the Spend-Risk matrix diagram.

Critical and high risk items are identified in the Supply Chains Design Map process and a tailored approach to buying established for these strategic items. For the more critical, complex or time sensitive items, this may require sourcing closer to the end market, to reduce the risk of disruptions.

Although low-cost production in Asia will remain a buying consideration, the absence of a low-cost item can still halt a production line. To reduce the risks, the emphasis (wherever possible) should be to not rely on clusters of similar suppliers in a geographic region (where all could be affected by a disruption) or on an individual country.

Geographic considerations

To reduce complexity in supply chains, the goal of ‘near-sourcing’ is now being promoted. That is, sourcing from a third party near to where the final product(s) is utilised or sold. As a start, Procurement professionals could group potential countries and locations within and outside their continent.

Group 1: high income countries, which are also attractive end markets for products. Suppliers within those countries can employ high skill and capable people and have the resources to implement automation to control costs. They are attractive for items that are high-value, high-tech and strategically important, complex production processes, as well as final (automated) assembly.

Group 2: can enable an expected time to market for items, have reliable transport links and costs, and membership of a trade bloc or agreement (examples are EU, USMCA, ASEAN and Asia-Pacific agreements). These countries have high labour skill levels, but lower labour costs than in high income countries.

Group 3: countries that have lower labour costs than the second group, but have proximity to the main markets for lower complexity items

Group 4: countries that may be longer distances to the high income markets, but have transport connectivity and reasonable logistics infrastructure. They aim to reduce carbon emissions and other ESG objectives

Group 5: established or new low-cost supply markets from where long lead times are accepted e.g. some countries in Asia

In Asia Pacific for example, LAL groups countries as (readers may have different combinations):

- Group 1: In Asia – Japan, South Korea, coastal China, Taiwan and Singapore. In the Pacific, Australia and New Zealand

- Group 2: coastal India, Vietnam, Thailand, Malaysia, Philippines

- Group 3: Indonesia, Bangladesh, Cambodia

Change is difficult

The need for change in sourcing criteria may be obvious, but the implementation of change is difficult and will be gradual. This is to allow risks associated with moving to new suppliers to be identified and reduced. The highest risk is that a new supplier promises to achieve the highest satisfaction, but is unable to perform consistently across all metrics. Time and resources to evaluate prospective suppliers will therefore be an important investment factor.

Be prepared for internal resistance to any proposed change in suppliers, especially if the risks are higher than the stakeholders ‘risk appetite’. As noted in the Reuters report “…You have inflation; you have unemployment; you have education levels; you have taxation rates; you have governance structures. All of that you can quantify to a certain degree. What you cannot quantify that easily is the geopolitical risk. This is where I’m focusing.” Karel Stransky, Head of Corporate Industrial Advisory, Occupier Services EMEA, Colliers

The effects from emergent events, such as geopolitical, are likely to be cumulative, because the events cannot be predicted with any certainty – they emerge from a conjunction of other events. The consequences for supply chains can therefore be very high in terms of ongoing business relationships and utilization of investments. Is it therefore better to work at improving relationships and processes with current suppliers to reduce current risks in your supply chains?