Asia Region trade initiative

The newly discovered importance of Supply Chains means that professionals can be expected to advise senior management and boards of directors concerning the longer-term supply chain influences on their business.

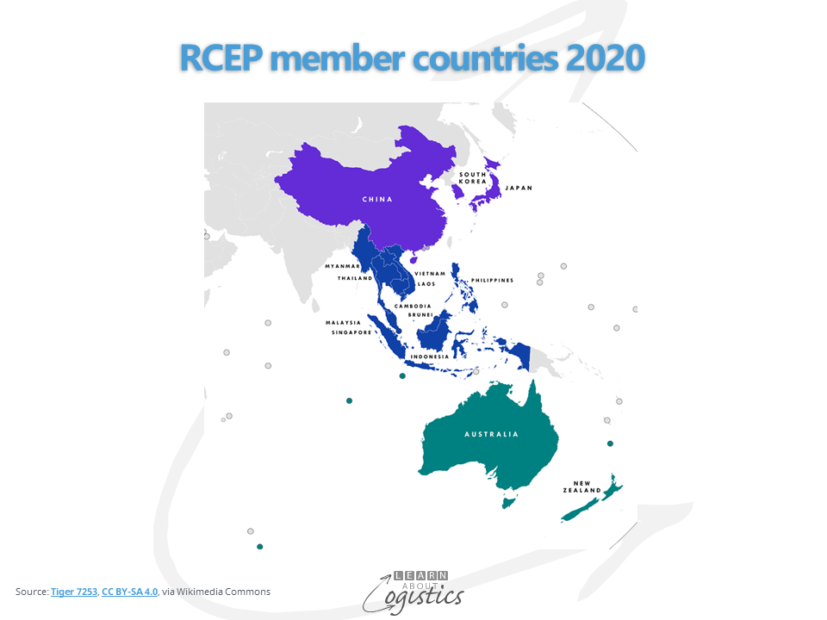

One of the influences is a move away from globalisation to a greater focus on regions and sub-regions. Region development in Asia has been advanced with the Regional Comprehensive Economic Partnership (RCEP). Virtually signed this month, the new trade facilitation agreement includes the 10 countries of ASEAN (Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam) and five of ASEAN’s main trading countries within similar time zones – Australia, China, Japan, New Zealand and South Korea.

This initiative has been led by ASEAN, with negotiations to harmonise the existing agreements that ASEAN had with each of the five developed countries into one multilateral model agreement. And this has taken eight years! In part, it is due to ASEAN requiring unanimous agreement for all decisions from its members. While this may be viewed as a weakness, it is also a strength for acceptance of the agreement. The time taken to complete negotiations has allowed the development of trust among the countries, such that future trade disputes can be fairly adjudicated by the secretariat between willing countries.

While all trade agreements contain a political element, the RCEP has initially focussed on trade matters that countries can more easily negotiate. However, the geopolitical ‘firsts’ for this agreement, which are important for the future, are:

- First multilateral trade agreement for China

- First trade agreement that includes China, Japan and South Korea

- First tariff reduction agreement between Japan and China

The RECP will, over time, reduce tariffs on trade in industrial and agricultural products between member countries and make it easier for market access; through using a single set of rules and procedures for accessing the preferential tariffs.

Even more important than reductions in tariffs is the removal of restrictions to trade, thereby improving the operations of supply chains:

- Use of one Certificate of Origin for region supply chains across multiple countries

- Rules covering e-commerce that make it easier for businesses to trade online

- Improved mechanisms for addressing non-tariff barriers, especially those used against agriculture and horticulture items. These include customs rules and procedures for documentation and classification of goods; quarantine inspection and technical standards for materials

- Common regulations concerning transport certification and for truck operators at border crossings

- Scope for increased trade in services, including telecommunications, professional and financial services

- A common set of rules concerning certainty of treatment for investments, competition and intellectual property, including digital copyright

There will be time to adjust supply chains, as all the terms in a trade agreement do not become effective immediately, as the governments negotiate a period of years for implementation. The RCEP agreement will most likely take effect within the next two years, after legal reviews and ratification by each country.

Structure of trade in the RCEP

Whereas trade within the EU and the US, Mexico and Canada Agreement (USMCA) is mainly comprised of finished goods, trade between the RCEP countries is mainly in intermediate goods, that is components, sub-assemblies and semi-finished process goods. Intra-Asian trade is estimated to exceed 70 percent of total trade by countries in the region and ‘intermediate goods’ is estimated to exceed 70 percent of total trade.

This pattern is assisted by the presence of multi-national companies (MNCs) that designate one or more owned or contracted locations in the region as the final assembly and shipping point for finished products. The MNCs import their intermediate goods from owned or contract facilities and suppliers located throughout the region which, in turn, purchase parts and materials in country. Purchase decisions are influenced by the established supplier networks, delivery time constraints and transport costs.

This pattern of trade and lower barriers to intra-regional trade and investment will assist companies that are based in individual countries of the region to broaden their markets; taking advantage of established and new supply chains. The pattern of trade and the development of automation technologies and associated software, will enable the assembly of finished goods to move closer to the areas of final consumption. This can provide low volume assembly that responds to demand volatility i.e. economies of scope, rather than economies of scale.

The challenge will be to encourage SME businesses to trade with member countries, using the RCEP mechanisms. The Australian Chamber of Commerce and Industry identified that about 60 percent of their members could take advantage of the Australia-USA trade agreement, but only 15 percent understood the complexity of the rules required for use in supply contracts. Automation of the Rule of Origin and product classification process within the RCEP is an opportunity for software developers to ensure client’s compliance and maintenance of auditable transactions.

The RCEP vs the CPTPP

Some commentators have observed that the RCEP lacks the depth and scope of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), an agreement that replaced the Trans-Pacific Partnership (TPP) when the US withdrew. The 11 member countries are Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam.

In the initial TPP negotiations, the US included provisions that did not come into effect in the CPTPP. Developing countries did not like restrictions concerning which trade policies they can retain or introduce and clauses which intrude into their domestic political decisions.

As the major attraction for developing countries of the original TPP was access to the US market, withdrawal of the US reduced the benefits. If the US would wish to re-join the CPTPP it could require substantial re-negotiation This and the agreement’s breadth across the Pacific, plus Asian country’s new focus on the RCEP, could make the long-term development of the CPTPP questionable.

If the RCEP has potential for your business, do not underestimate the time involved to understand it; undertake a supply chain analysis and quantify the potential risks. Then, using the evidence, present to senior management a revised approach for your organisation’s supply network.