Relationships and power.

Relationships in Supply Chains are not static; as corporate policy and the broader business environment change, so will the dynamics between buyer and seller. My previous post ‘Business strategy decisions and Supply Chain outcomes’ discussed the effect on Logistics from a change to a retailer’s pricing policy. But changing the pricing mechanism is also an example of events that can affect business relationships.

In the retail example, the company intends to move from a ‘high-low’ to an ‘everyday’ pricing model. Under a ‘high-low’ pricing strategy, the retail buyers use power based on the large order quantity to obtain reduced purchase prices (reducing the supplier’s gross margin) through:

- Emphasising the retail organisation’s buying volume for seasonal purchases

- Using leverage – promoting the organisation’s brand, reputation, recognition and prestige as a buying ‘lever’

- Exploiting a supplier’s dependency on the buying organisation or the Supply Chain (apparel for example). The buyer will need to:

- Research the availability of credible substitute suppliers and the cost to find and evaluate a replacement supplier

- Ascertain the strength of business relationships between the supplier and their suppliers

Changing to an ‘everyday’ pricing strategy will require buyers to approach suppliers in a more collaborative manner. The focus will be on gaining agreement for longer term fixed price contracts and long term product development cycles. A more collaborative approach allows suppliers to evaluate the relationship in a new light and to use the new situation as the basis for negotiation, considering:

- buyer’s total annual expenditure with the supplier

- ratio of buyer’s orders to total sales revenue

- regularity and predictability of the buyer’s orders and timing of payment

- ease of replacing the buyer’s business

- value of association with prestigious buyer

Although the example given is retailing, changes to relationships with suppliers can occur in your business, as relationships with customers change.

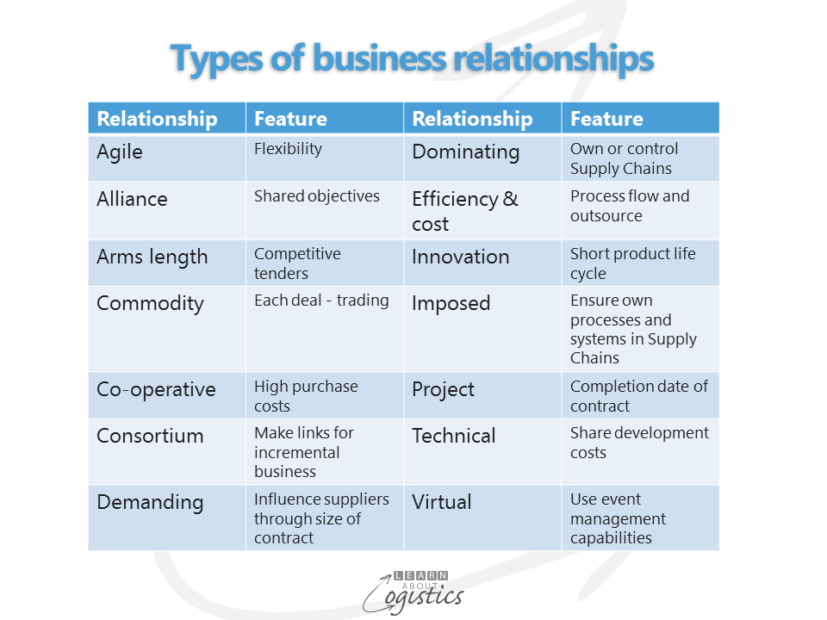

So, how many types of relationships are there and what is the evaluation process to gain competitive advantage from a business relationship? The table below provides a selection of relationships (there are likely to be more). You will notice the term partnership is not listed – for a very good reason. A partnership is the sharing of risk and reward and because this is so rare in business, the term is meaningless (although beloved of journalists and consultants).

Although we use the term Supply Chain in a generic way, Supply Chains must be defined through each node and link of a Network. An organisation will have multiple relationships with different buyers and sellers, but importantly, each relationship types listed in the table has an equal standing with the others. This is because a relationship is dependent on the business and economic circumstances at a point in time, together with the power that is exercised by either party to further their business objectives.

Power in negotiations

A business relationship has a conflict of interests between the parties negotiating a contract (written or verbal). However, the resolution is determined by the commercial and operational attributes and resources that a party can demonstrate, in comparison with those of the other party(s) and placed against the needs and wants of each party. This is the exercise of power. So, use of power is the ability of one party to influence the behaviour of the other party in a manner that is contrary to their desired interests.

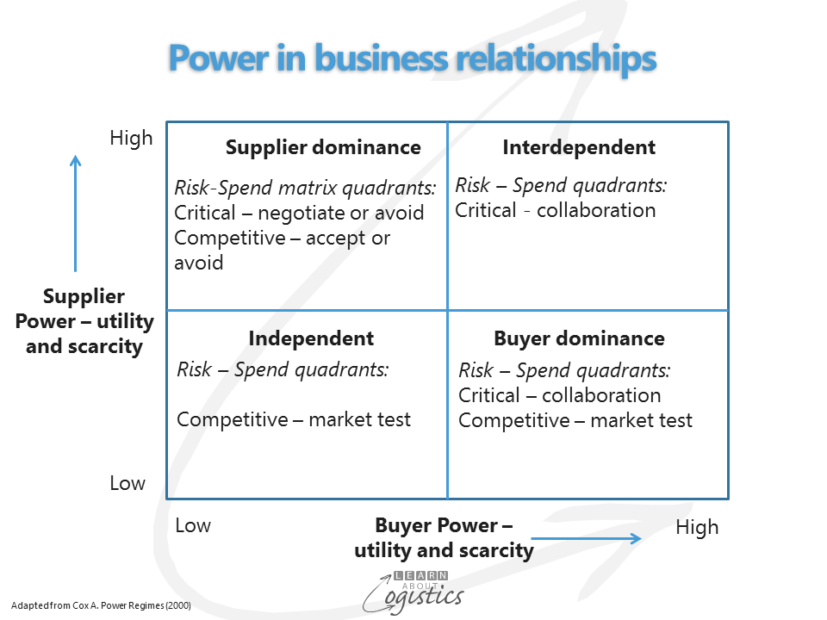

There are four outcomes from using power in negotiating a relationships; where the:

- supplier is dominant

- buyer is dominant

- buyer and seller are interdependent. Potential for an ‘Alliance’ type relationship. Share risk and reward

- buyer and seller are independent. High level of competition in the market; if a ‘good’ deal not offered customers can easily move

Utility is the economist term for the perceived ability to satisfy needs or wants; scarcity refers to the lack of opportunity to identify alternatives. These are the Power attributes and resources. The Risk-Spend matrix and its relationship to Power and Dependency and Supplier Positioning are at the post ‘Fit your organisation within a supply market’, which discusses a structured approach for using power.

The matrix above is applied within each of the quadrants of the Risk-Spend matrix. In addition, applying the Supplier Positioning matrix to the Risk-Spend matrix provides a 4 x 4 x 4 view of the permutations possible to gain an understanding of the potential scope, use and limitations of power by both parties within a business relationship.

Business relationships are capable of delivering beneficial and negative outcomes. Understanding the use of power in business relationships and how relationships can impact an organisation, its suppliers and customers is an important factor in successful Supply Chains. Yet, because the term ‘power’ has bad connotations, formal education courses appear to avoid studying the topic in any depth, leaving it to be learnt ‘on the job’.